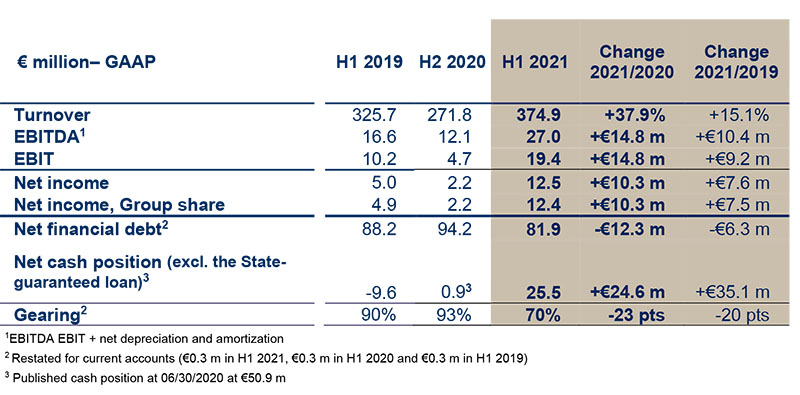

Strong improvement in performance indicators in first-half 2021

- Improvement across all businesses: +37.9% growth versus H1 2020

- EBITDA x2.2 versus H1 2020

- Net income, Group share x5.6 versus H1 2020

- Strengthened net cash position of €25.5 million (following the redemption of State-guaranteed loans)

HERIGE has released its results for first-half 2021. The consolidated financial statements were examined by the Supervisory Board at its meeting on September 3, 2021.

HERIGE has released its results for first-half 2021. The consolidated financial statements were examined by the Supervisory Board at its meeting on September 3, 2021.Commenting on the Group’s first-half 2021 results, Chairman of the Executive Board of HERIGE Group, Benoît Hennaut, said: “The good performance in the first half of 2021, driven by momentum in our markets, reflects the changes made within the Group. It not only demonstrates HERIGE’s capacity to adapt, thanks to its highly committed teams who have rallied round in these unprecedented times, but also our ability to take on change. HERIGE will continue to roll out its performance and optimization measures in order to sustain its profitable growth strategy. Lastly, the Group will consolidate its position as the reference in all the regions in which it operates, by offering a complete range of innovative, differentiating and more sustainable solutions for construction stakeholders.”

Significant improvement in operating performance driven by improved margins and optimization of expense ratio against a backdrop of growth

In first-half 2021, HERIGE posted turnover of €374.9 million, a strong increase of 37.9% year on year (up 37.7% like-for-like) and of 15.1% compared to the same period in 2019 (up 13.9% like-for-like). Since June 2020, the Group's three businesses have continued their strong rebound, thanks to a full range of products and innovative services.

Following the upturn in business in the first half of the year, HERIGE Group posted a gross margin of €146 million, up €41.6 million compared to first-half 2020 (up €24.2 million compared to first-half 2019), representing a gross margin of 38.9% of turnover, up 0.5% versus 2019.

EBITDA for first-half 2021 amounted to €27 million, up €14.8 million on first-half 2020 and up €10.4 million compared to the same period in 2019.

The momentum recorded across all HERIGE's businesses, combined with the Group's performance actions, resulted in a substantial improvement in operating profit (up €14.8 million versus H1 2020 and up €9.2 million versus H1 2019), which came in at €19.4 million, representing an operating margin of 5.2% versus 1.7% one year earlier and 3.1% in first-half 2019.

After taking into account a net financial expense of €0.8 million (versus €0.6 million in H1 2020 and €0.9 million in H1 2019), a non-recurring loss of €0.2 million (versus non-recurring income of €0.4 million one year earlier and a loss of €0.9 million in H1 2019), net income, Group share amounted to €12.4 million in first-half 2021, compared with €2.2 million for first-half 2020 and €4.9 million for first-half 2019.

Financial position: rebound in investments and reduction in net debt

In a more favorable market, HERIGE resumed its investments, which amounted to €10.4 million, up €2.7 million on the same period in 2020.

At June 30, 2021, the Group maintained a robust financial structure with shareholders’ equity totaling €117.1 million, a positive net cash position of €25.5 million (after the repayment of State-guaranteed loans) compared to €0.9 million at June 30, 2020 (excluding State-guaranteed loans). Thanks to our cash flow and careful management of working capital, and despite resuming a dynamic investment policy, net financial debt fell to €81.9 million, representing a net gearing ratio of 70%, down 23 points compared to end-June 2020 and down 20 points compared to end-June 2019.

In addition, in accordance with its commitments, all State-guaranteed loans taken out to secure its cash flow during the health crisis were repaid at June 30, 2021.

Outlook and developments

In second-half 2021, against a higher basis for comparison and a macroeconomic backdrop still marked by uncertainty, the Group is expected to continue to enjoy strong momentum across all its markets.

It is still on the lookout for opportunities that could serve its profitable growth strategy.

Lastly, the Group has confirmed its development priorities:

- Be the reference in all the regions where the Group operates,

- Develop an ambitious CSR policy,

- Develop innovative and differentiating products and services.

NEXT PUBLICATION: Q3 2021 turnover on November 9, 2021 (after the close of trading)

All our financial communications are available on our website: www.groupe-herige.fr

>> Dowload the press release (pdf - 248 Ko)