Very good performance confirming the Group’s strength in an inflationary context

- Growth across all three businesses: +10.2%

- Improvement in operating performance: EBITDA up 14.9%, EBIT up 15.9%

- Acquisitions strategy continues

HERIGE has released its first-half 2022 results. The consolidated financial statements were examined by the Supervisory Board at its meeting of September 9, 2022.

Commenting on the Group’s first-half 2022 results, Benoît Hennaut, Chairman of the Executive Board of HERIGE Group, said: “HERIGE delivered a very good performance in the first half of 2022 demonstrating solid growth and improved operating profitability. The Group’s discipline has enabled us to pass on cost increases, thus protecting our margins while keeping a close watch on inflation. In addition, we have continued to pursue our acquisitions strategy in view of strengthening our positioning on our various markets through transactions that are in line with our ambitions for profitable growth and our commitment to sustainability.”

Ongoing improvement in operating performance despite a complex environment

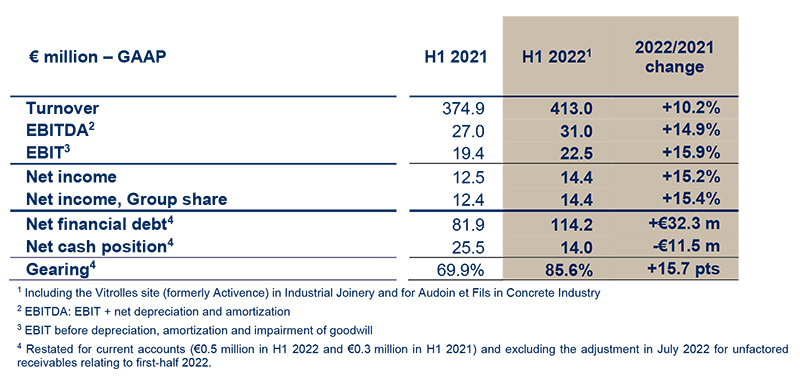

In first-half 2022, HERIGE posted turnover of €413.0 million, an increase of 10.2% (up 8.7% like-for-like), driven by the Group’s three businesses, benefiting from a favorable price effect and, to a lesser extent, a favorable volume/product mix effect.

Gross margin came in at €162.9 million, up €16.9 million compared to first-half 2021, representing a gross margin of 39.4% of turnover, up 0.5 points versus 2021.

Despite inflationary pressures on raw materials, transport and energy, EBITDA for first-half 2022 increased by 14.9% to €31.0 million compared with the same period in 2021 and the EBIDTA margin stood at 7.5% (up 0.3 points versus H1 2021).

The momentum recorded across all of HERIGE’s businesses, combined with a continued focus on costs, has driven operating profit up 15.9% versus H1 2021 to €22.5 million, representing an operating margin of 5.4% versus 5.2% one year earlier.

After taking into account a net financial expense of €0.6 million (versus €0.8 million in H1 2021) and a net non-recurring loss of €0.4 million (versus €0.2 million one year earlier), net income, Group share amounted to €14.4 million in first-half 2022 compared with €12.4 million in first-half 2021.

Robust financial structure

Investments amounted to €9.3 million in first-half 2022. At June 30, 2022, the positive net cash position of €14.0 million was temporarily impacted by an IT incident in the factoring department. Adjusted for this impact regularized in July 2022, net cash amounted to €23.1 million at 30 June 2022, compared with €25.5 million at 30 June 2021, and net financial debt remained under control at €105.1 million (compared with €114.2 million as reported).

With shareholders’ equity of €133.5 million, the adjusted net gearing ratio was 78.7% (versus the reported figure of 85.6%) compared with 69.9% one year earlier.

This confirms the solidity of the Group’s financial structure, which enables it to carry out new acquisitions.

Outlook and developments

In the coming quarters, in an environment marked by uncertainty including the first signs of a downturn in the construction market, the Group will continue to focus on:

- accelerating CSR initiatives within all its businesses and implementing non-financial reporting by 2023,

- rolling out its energy efficiency offers,

- consolidating its performances, particularly in terms of resilience to inflationary pressures, which means finding the right balance between volume and operating performance,

- integrating the latest acquisitions in the Industrial Joinery and Circular Concrete businesses.

In addition, HERIGE intends to pursue its pro-active and contributive acquisition policy to improve its sustainable performance, including the major strategic project to acquire the PORALU Group announced on July 28, 2022. Second-half 2022 should also see the initial benefits of the Group’s recent acquisition of MGT Menuiseries Bois, which was completed after the reporting date.

NEXT PUBLICATION: Q3 2022 turnover on November 8, 2022 (after the close of trading)

All our financial communications are available on our website: www.groupe-herige.fr/en

>> Download the press release (pdf - 293 Ko)