Stable gross margin

Ongoing internal investment and cut in net debt

Gradual improvement in profitability

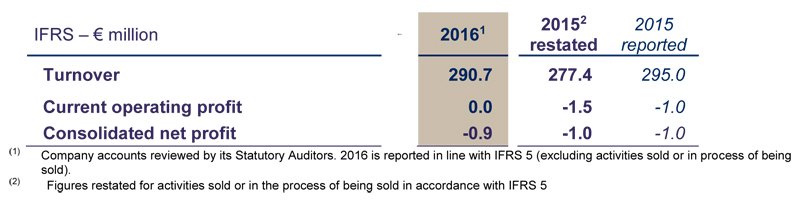

HERIGE posted a 4.8% increase in turnover (after IFRS 5 application) for the first half of 2016, maintaining the momentum seen since the second half of 2015 despite a construction market that has yet to enjoy a tangible rebound.

At 37.9% of turnover, the Group's gross margin remained relatively stable and continued to reflect a fiercely competitive global market, particularly for the Group's industrial divisions.

The gradual pick-up in activity led to an increase in HERIGE's external costs (+5.5%) and personnel expenses (+3.0%). Current operating profit reached breakeven on 30 June 2016 versus a current operating loss of €1.5 million one year earlier.

Impacted by extraordinary expenses, consolidated net profit amounted to -€0.9 million as against -€1.0 million on 30 June 2015.

Financial situation: ongoing internal investment and cut in net debt

The first half of the year saw HERIGE Group maintain its programme of internal investment to renew and improve its logistics and production resources (€5.7 million on 30 June 2016 compared with €7.2 million on 30 June 2015, before IFRS 5 application). It was also able to cut net debt by 17.4% (€89.3 million at end-June 2016 compared with €108.1 million at end-June 2015), taking gearing to 81% as against 85% on 30 June 2015 (before IFRS 5 application). It was also able to cut net debt by 17.4% (€89.3 million at end-June 2016 compared with €108.1 million at end-June 2015), taking gearing to 81% as against 85% on 30 June 2015 (before IFRS 5 application).

Outlook and developments

Stronger sales remain the Group's priority as it seeks to progressively restore the profitability needed to finance its future development.

NEXT PUBLICATION: Q3 2016 turnover on 8 November 2016 (after the stock exchange closes).

All our financial communications are available on our website www.groupe-herige.fr